management accountants / 12 posts found

Writing a mission statement

You've had your initial business idea and written a plan. But do you know WHY you're creating this business, or HOW you’ll deliver your end product/service? What will the company's underlying purpose be and how will your core values drive the business? To get these crucial elements ironed out, it’s a good idea to write a ‘mission statement’ for your startup – a short summary of the aims and values of your business. WHAT does your business do? The first thing to pin down is what the business actually does – i.e. at the most basic level, what is the [...]

How to safeguard your team’s mental health

The coronavirus pandemic has forced a significant amount of change and upheaval onto you and your team – in a very short amount of time. We’ve gone from ‘business as usual’ to closed offices, working from home and the full reality of isolation during an emergency lockdown. To combat this change, it’s important to take steps to care for your employees. Key ways to take care your teams wellbeing There’s no single solution when it comes to taking care of your employees’ wellbeing. For your people to cope with their new enforced remote working life, they’ll need to consider everything [...]

Create a one-page business plan

To make a success of your business, you’re going to need a robust business plan - particularly as we face challenging times. With a one-page business plan behind you, the company has a real sense of strategic direction and a set of core goals to refer to and track against. But what are the key elements to include in your one-pager business plan? We’ve listed some of the foundational areas to cover, so there’s real purpose behind your return to trading. What to include in your business plan Lots of online resources will suggest that a business plan is an [...]

Are you lonely?

Running a business can be a very lonely lifestyle. You probably went into business for a whole host of good reasons, and with a clear understanding of the problems that running your own business can bring you. But you might not have considered the loneliness. Endlessly making decisions by yourself, holding the sole responsibility for the consequences of those decisions can wear people down. This is not a sign of weakness, it is merely a reflection of the difficult nature of running a business. Every decision that you make will have a ripple effect of consequences. For example, the pound [...]

Genuine confidence

There are countless blogs on confidence in business. How to stand, what colour suit to wear, how to speak, what tone and pitch of voice to use. Lots of these tips are brilliant and can really help you to present yourself in a better manner, with improved results. However, genuine confidence comes from knowing and understanding your business inside out. You can pull off the good outward presentation and gain clients that way, but true confidence comes from within. Knowing exactly what is happening in your business will give you an edge over your competitors. If you understand the mechanics [...]

How do we prepare for Brexit when so much is undecided?

It is hardly surprising that Brexit is fast becoming as big a turnoff as tax. How on earth are we supposed to react or adapt to such far-reaching changes when the exact details of our exit are still undecided just a few weeks before the March 2019 deadline? Businesses that buy or sell goods to the EU must be pulling their corporate hair out – just how will their supply lines be affected? A new government website covering possible Brexit consequences The government has already published a bunch of documentation setting out the consequences of a no-deal outcome and they [...]

Why does the UK tax year end 5th April?

A bit of history this week but with a practical outcome for 2019. Up to 1582, Europe used the Julian calendar introduced by the Romans in 45BC. Unfortunately, the Julian calendar differed from the solar calendar by 11 ½ minutes; after 500 years this small difference meant that the Julian calendar was 10 days off the solar calendar. To remedy this error, Pope Gregory introduced the Gregorian calendar in most of Europe under his influence, 1582. There was a notable exception, you guessed right, the British Empire. Sound familiar? The Brits stoically maintained their use of the [...]

Proposals for consumer protections when companies collapse

The government is to consider new laws to protect consumers who have prepaid for products when a business becomes insolvent. Government to consider new laws to protect consumers who have prepaid for products when a business becomes insolvent proposed measures will include guaranteeing consumer schemes like Christmas savings clubs can safeguard customers’ money reforms are part of the government’s modern Industrial Strategy to ensure markets work in the interests of consumers New laws to protect consumers who have already paid for products but not received them when businesses go bust will be considered by the government, it was [...]

Brexit may be in limbo, but Making Tax Digital is not

As we have highlighted in many posts to this blog, from 1 April 2019, ALL VAT registered businesses with turnover above the £85,000 VAT registration threshold will have to submit their VAT returns from within software that can link with HMRC’s networks. In techno- speak, your data will need to be transferred using a designated API (HMRC’s application programming interface). The fact that you have always prepared your VAT returns electronically, for example, by using a spreadsheet to record transactions and create the data for your VAT returns, will not be enough. Your spreadsheet will not have the functionality [...]

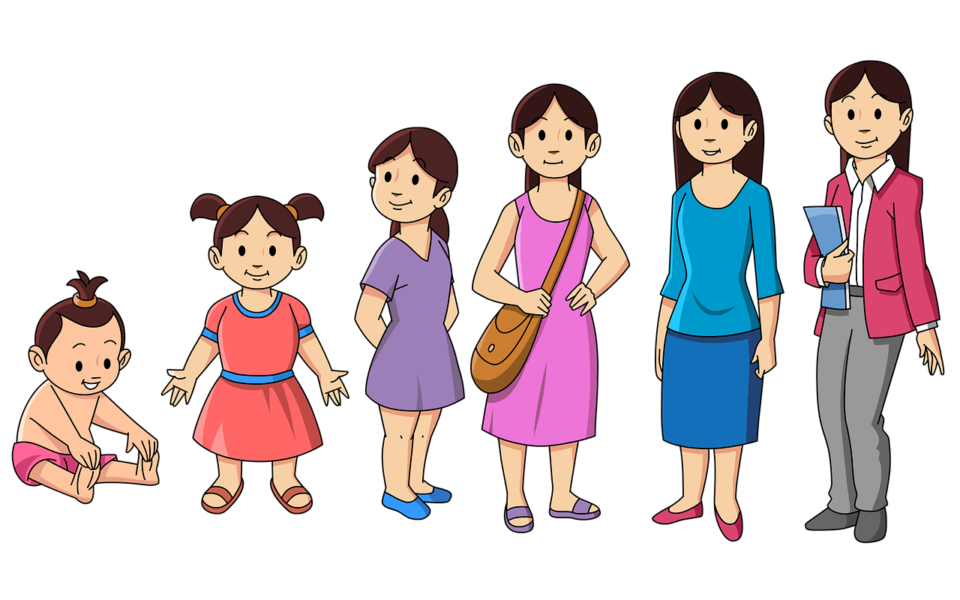

What are you basing your planning on?

One of the difficult things about being a parent is the constant changing. Sometimes it seems as though no sooner have you got yourself sorted, than your child changes. So, the tricks that worked last year no longer seem to work, and the activities that were perfect and enjoyable 6 months ago are suddenly no longer relevant. Planning ahead includes factoring in how your child may change in the intervening period of time. You can’t work out how to entertain a 6-year-old through the holidays based on what you did with a 4-year-old; it simply won’t work. Businesses are similar [...]