accountants / 66 posts found

How are dividends taxed?

Dividends received from shares held in UK companies form part of a tax-payers self-assessment. The payments are made by the paying company without any deduction of tax and therefore the amount received is the sum that needs to be declared. Dividends are paid out of the company’s retained profits – these are profits after any corporation tax has been paid – once these reserves are exhausted, it is illegal to declare or pay any further dividends. Tax payable on dividends received by shareholders is not payable at income rates (20%, 40% or 45%), but as hybrid rates. The rates for [...]

Why does the UK tax year end 5th April?

A bit of history this week but with a practical outcome for 2019. Up to 1582, Europe used the Julian calendar introduced by the Romans in 45BC. Unfortunately, the Julian calendar differed from the solar calendar by 11 ½ minutes; after 500 years this small difference meant that the Julian calendar was 10 days off the solar calendar. To remedy this error, Pope Gregory introduced the Gregorian calendar in most of Europe under his influence, 1582. There was a notable exception, you guessed right, the British Empire. Sound familiar? The Brits stoically maintained their use of the [...]

Turkey dinner and tax returns

Completing your tax return may not have been top of your priorities on Christmas Day, but that didn’t stop 2,616 taxpayers from filing their Self-Assessment returns on 25 December 2018. For some taxpayers completing their return on Christmas Day is as traditional as spending time with family and friends or waiting for the Boxing Day sales to start. The peak filing time, according to HMRC, was between 1pm and 2pm, when more than 230 customers filed. Angela MacDonald, HMRC’s Director General for Customer Services, said: This year, more than 2,600 taxpayers chose to file their returns on Christmas Day. Whether [...]

What are you basing your planning on?

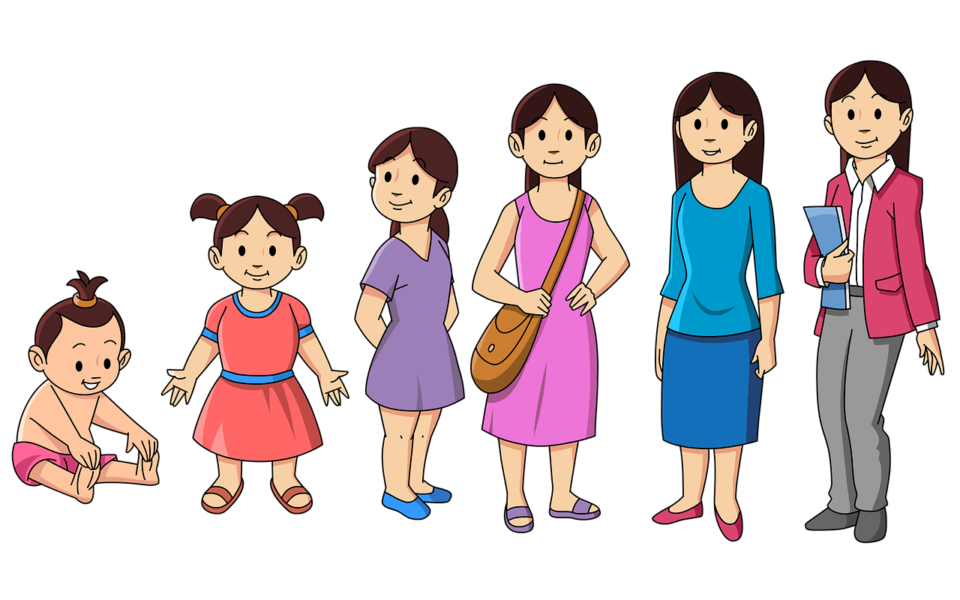

One of the difficult things about being a parent is the constant changing. Sometimes it seems as though no sooner have you got yourself sorted, than your child changes. So, the tricks that worked last year no longer seem to work, and the activities that were perfect and enjoyable 6 months ago are suddenly no longer relevant. Planning ahead includes factoring in how your child may change in the intervening period of time. You can’t work out how to entertain a 6-year-old through the holidays based on what you did with a 4-year-old; it simply won’t work. Businesses are similar [...]

Why do I need a management accountant?

Firstly, it is important to understand what a management accountant is and how this differs from the more traditional financial accountant. A management accountant will provide on-going reports into the operation of your business, enabling you to make strategic decisions. A financial accountant provides you with end of year reporting, showing you what has happened over the previous year. A management accountant can generally produce the financial reporting as required by HMRC, but a financial accountant will not necessarily offer the services of a management accountant. While there are many great reasons to use a management accountant, we have picked [...]

Keep private bank accounts private

Many small businesses, including landlords, use personal bank accounts to lodge business receipts and make business payments. If traders in this situation are subject to a HMRC enquiry into their business affairs, HMRC would be entitled to request sight of all bank accounts that record business transactions even if those accounts are essentially, personal bank accounts. As many of the transactions in these accounts are personal, you may need to explain to HMRC where credits to the account came from and provide evidence that the credits are nothing to do with your business. Without this confirmation or evidence, [...]

How do you eat an elephant?

The answer is, of course, a little bit at a time. Goal, dreams or aims are like elephants, it is far too overwhelming to have your goal as make a million pounds, but breaking that goal down into manageable bite sized pieces will make the obtaining of your goal possible, and certainly more probable. We have reached the time of year when we start to think about next year and what we want to achieve going forwards, so now is a good time to start understanding how to set out good goals, to enable you to reach your final aim. [...]

Struggling with growth?

Trying to achieve increased growth can seem a daunting prospect, but as with most thing in business and life, once broken down it becomes clearer. There are only 4 ways to increase growth. 1.Increase the number of customers or transactions. Increase the average value of existing transactions. Increase the gross profit margin on your products and services Introduce a new product or service So, for each of these we can come up with a strategy that may help. Firstly, increase your customers or transactions. This can be finding new customers or encouraging your existing customers to order more frequently. [...]